I admit, this is a bit off topic given the theme of my other posts, but I got to thinking about this and had to scratch the itch.

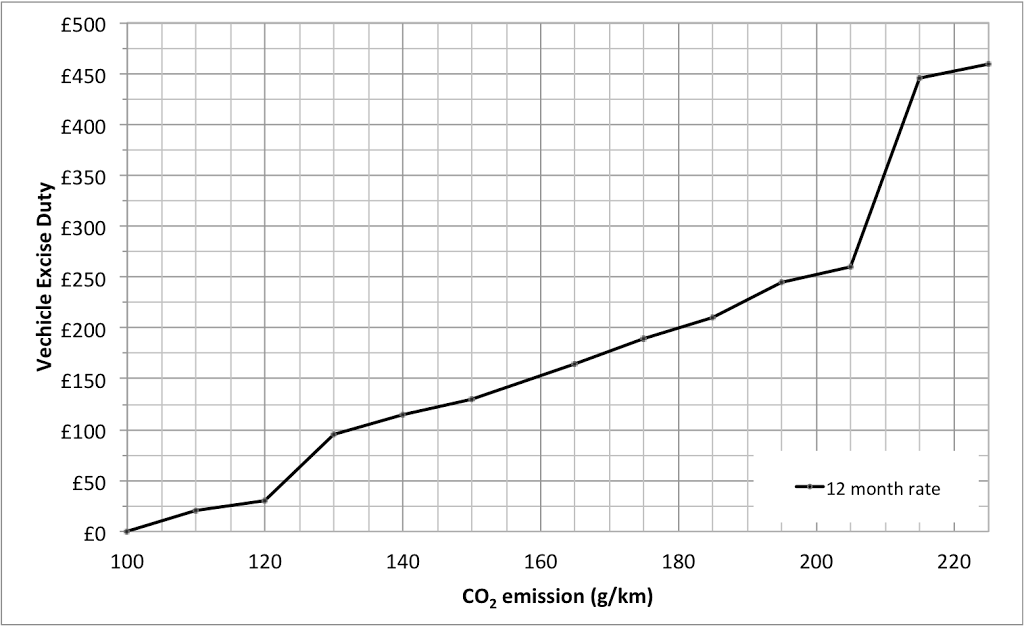

Cars and lorries in the UK have to pay a duty called the Vehicle Excise Duty (often erroneously called Road Tax). The cost of the duty is a function of the amount of carbon your vehicle emits up to a maximum of 225g/km. The graph below shows the cost for the thirteen bands:

It’s interesting to note that there’s not a linear relationship between the carbon emissions and the cost, which is odd. Who decided these bands and the associated cost, and how did they choose them?

I cycle to work daily, and wondered where on that chart a cyclist might fall. Some brief searching gave me this Guardian article with some analysis of the carbon output from cycling. The article states the very existence of a bike means it’s encumbered with a 50g/mile carbon footprint (which in sensible units is 31.07g/km). Since all motion requires a force (and thus energy — see Newton’s Laws of Motion), then making a bike move increases the carbon footprint. The Guardian article uses five different energy sources for the person powering the bike (bananas, cereal with milk, bacon, cheeseburgers and air-freighted asparagus) giving a range of energy consumption rates of 65g/mile, 90g/mile, 200g/mile, 260g/mile and 2800g/mile, which is sensible units is 40.4g/km, 55.9g/km, 124.3g/km, 161.6g/km and 1739.9g/km.

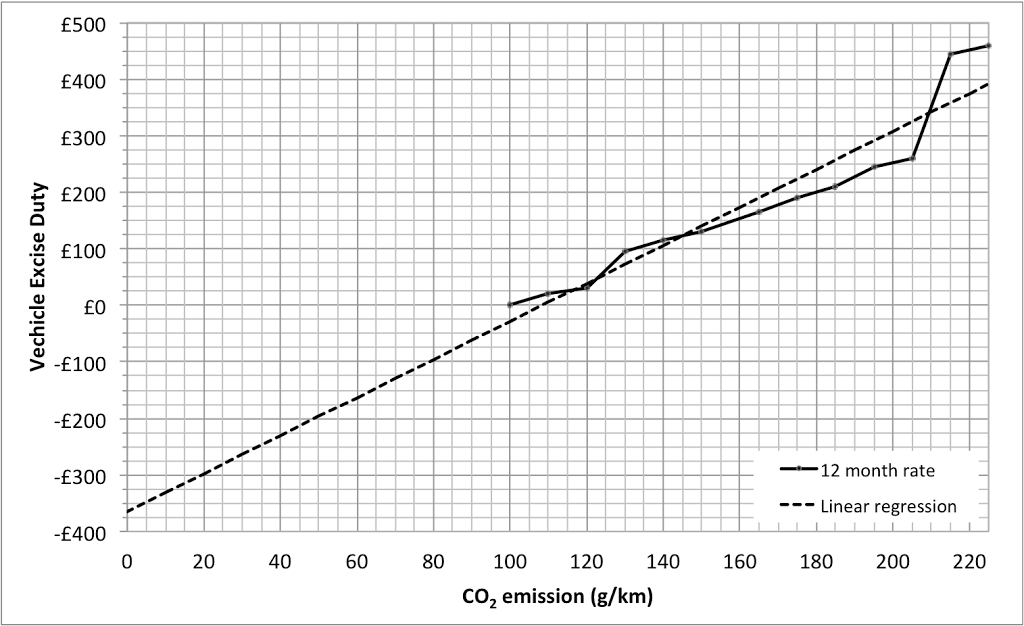

This gives us a range of values for the cyclist which we can compare with the car emissions, however, the range of values used in the calculation of the Vehicle Excise Duty only goes as low as 100g/km, for the banana powered cyclist, we need a lower value. Since the Vehicle Excise Duty appears to be roughly linearly correlated with the carbon emission, let’s extrapolate backwards. The graph below shows the same values as in the first graph, but with a linear regression backwards to zero carbon emission.

Using the linear regression, we can now calculate the Vehicle Excise Duty for any carbon emission rate. So, for the five cycling carbon emission rates calculated by the Guardian, we get Vehicle Excise Duty rates for cyclists of:

- Banana (40.4g/km)

- -£229.45

- Cereal with milk (55.9g/km)

- -£177.31

- Bacon (124.3g/km)

- £52.77

- Cheeseburger (161.6g/km)

- £178.24

- Air-freighted asparagus (1739.9g/km)

- £5487.33

If the Vehicle Excise Duty tax weren’t set with a minimum (for all vehicles whose emissions are below 100g/km), then using this approach, a banana-fuelled cyclist should receive a £229.45 annual rebate. A more commonly cereal-with-milk-fuelled cyclist ought to receive a £177.31 rebate whilst those cyclists feasting on less healthy fare (bacon and cheeseburgers) would have to pay £52.77 and £178.24 respectively. Anyone who manages to sustain themselves on asparagus alone deserves everything they get, including a £5487.33 Vehicle Excise Duty bill.